Oct 1, 2024

We’re thrilled to announce the next chapter in our product journey — cSigma Edge, a permissionless RWA (Real-World Asset) protocol designed for community lenders around the globe. Since 2023, cSigma Institutional has laid the foundation for institutional-grade decentralized finance (DeFi) lending, providing growing enterprises with access to private credit. Today, we take a bold step forward with Edge, a platform that opens the door for individual lenders to participate in the same opportunities previously reserved for institutions.

With the global demand for DeFi credit solutions on the rise, cSigma Edge enables community lenders to provide stablecoin liquidity (USDC and USDT) to real-world companies making a tangible impact. Edge will be available in most countries, except for the United States and United Kingdom, allowing lenders to lend to enterprise borrowers across established financial markets such as Europe, North America, and Hong Kong. Edge will be launched on October 14th on Ethereum.

What is cSigma Edge?

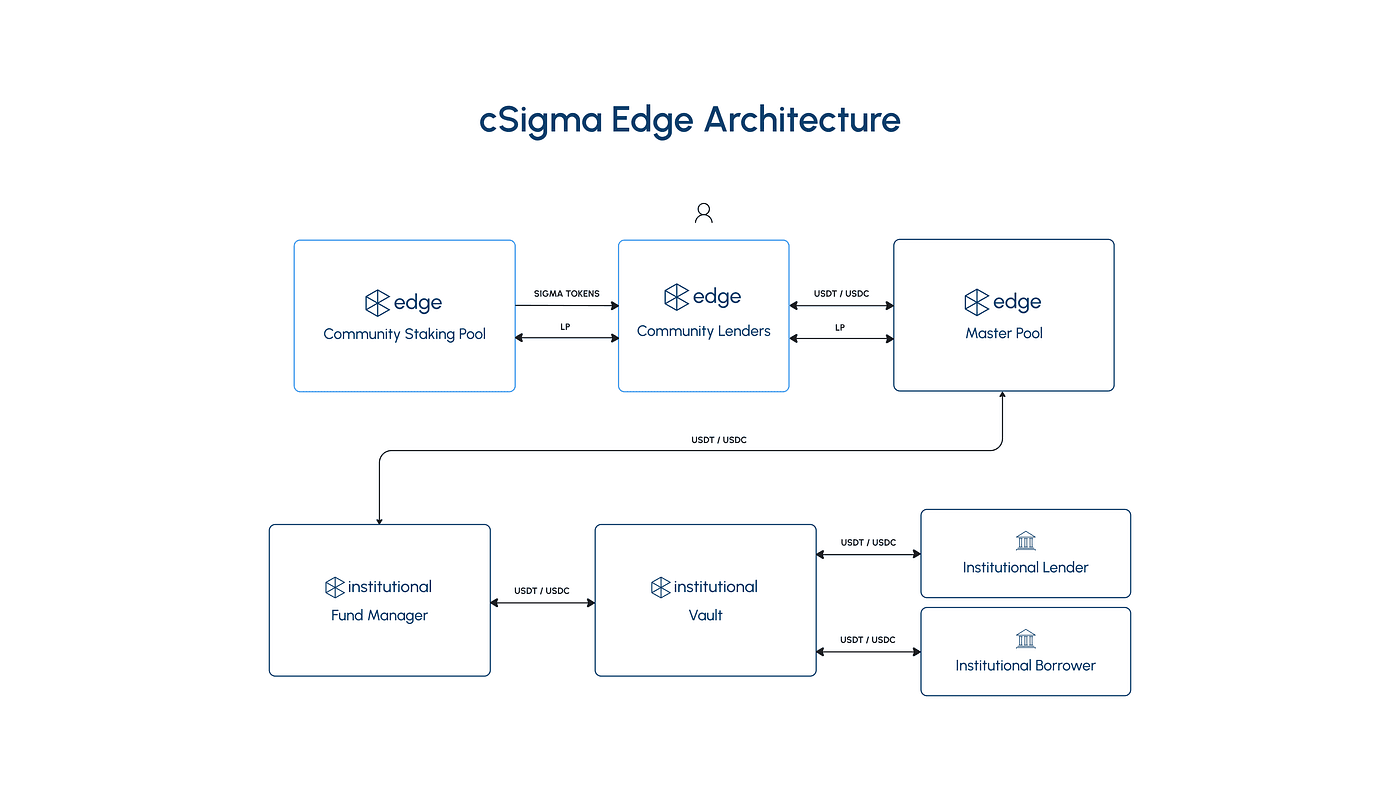

cSigma Edge is a stablecoin lending platform designed to empower individual lenders. Users can lend into Edge pools which create a portfolio of borrowers diversifying risk. These pools lend capital to multiple borrowing enterprises in cSigma Institutional, which continuously assesses credit quality and monitors collateral until the loan is repaid. Borrowers receive short-term loans (3 to 12 months) backed by liquid financial assets, such as accounts receivable and contracted revenue, alongside additional credit protections like credit insurance.

Key Differences of cSigma Institutional vs. Edge

cSigma Institutional provides institutional investors with tokenized private credit investment opportunities. This version features advanced AI-driven credit analysis, pricing, and risk management, and ensures that institutional lenders adhere to stringent KYC and AML requirements. Institutional lenders also benefit from access to extensive borrower data, loan agreements, and real-time risk information on borrowers.

In contrast, cSigma Edge is built on the same institutional foundation while offering access to individual community lenders. Edge operates through automated Master Pool Managers, who manage the capital deposited by community lenders. These managers construct diversified borrower portfolios, and ensure enough cash reserve to support withdrawals.

Key Features of cSigma Edge: Empowering Community Lenders Worldwide

cSigma Edge breaks down traditional barriers, making high-quality lending opportunities globally accessible across multiple blockchain networks. It democratizes access to private credit — once reserved for institutions with significant capital and resources — and simplifies the credit investing process using Artificial Intelligence.

Here’s how Edge empowers community lenders:

1. Democratized Access Through Permissionless Pools

Edge removes gatekeeping, enabling both experienced investors and newcomers to participate easily in global lending opportunities without geographical limitations. Simply connect your wallet and you’ll be able to lend stablecoins into Credit pools.

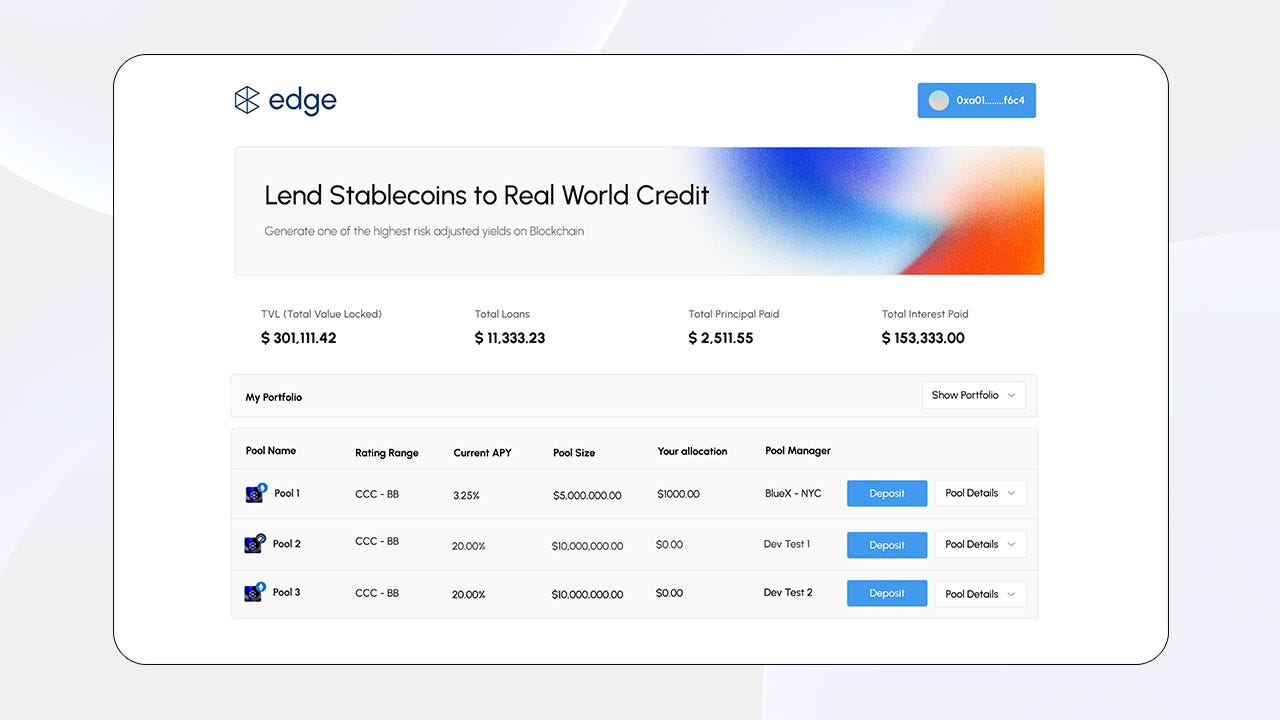

Explore Pools on cSigma Edge

Community lenders can start with a minimum investment of $1,000 USDT/USDC, making it easy to create diversified yields from industries like trade finance, insurance, and solar.

2. Instantaneous Lending, No Onboarding Required

With any supported Wallet and Stablecoins, community lenders can lend their capital in minutes. Edge eliminates onboarding friction, allowing lenders to seamlessly deploy capital with high-quality borrowers. You can withdraw your capital anytime from the reserve cash available in the Master Pool.

3. Full Transparency and Control

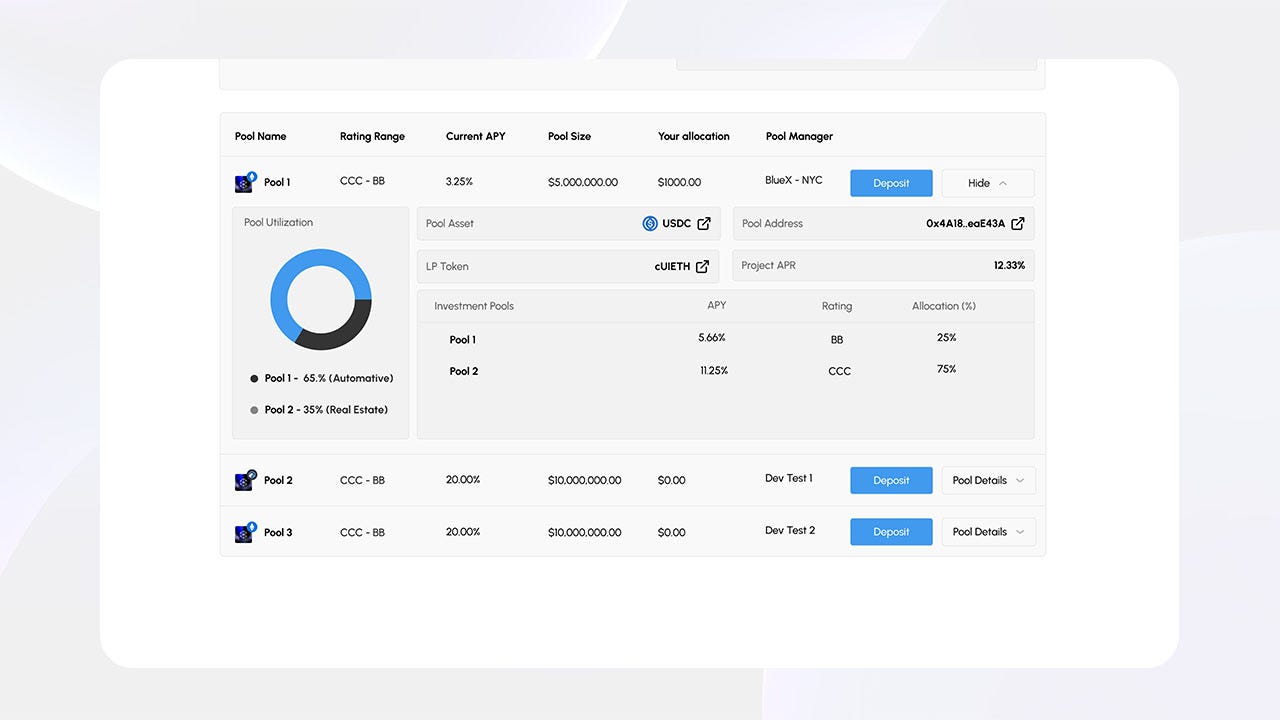

Edge provides complete transparency into where your funds are deployed, accumulated interest, loan maturity timelines, and borrower risk profiles that are continuously updated.

cSigma Edge Pool Utilization

5. Support SMBs and Earn Competitive Yields

Many cSigma Edge borrowers lend to SMBs in North America, Asia, and Europe, enabling them to grow and serve their communities. Lenders on Edge can earn competitive yields while supporting growing businesses.

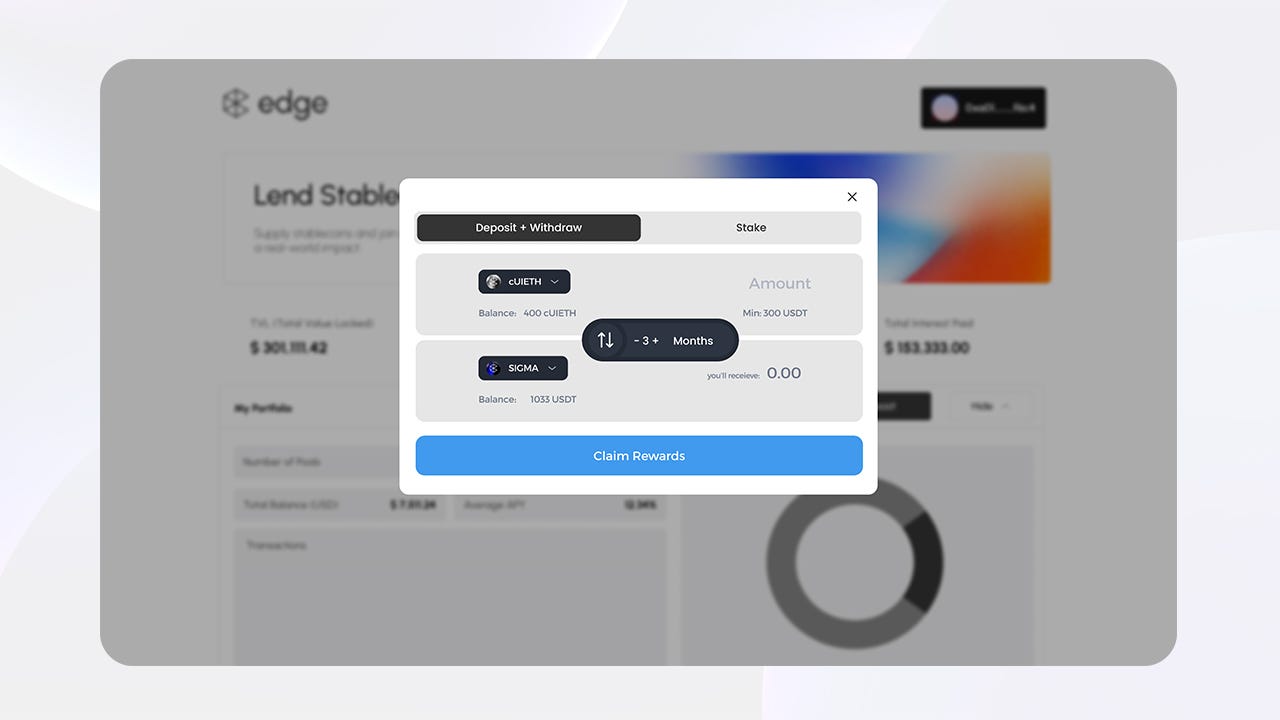

6. Earn SIGMA Token Rewards

To grow our community, we are offering generous SIGMA token rewards for early lenders . Those who stake their capital for longer durations will receive additional rewards.

Claim SIGMA Token Rewards

The Future of Community-Driven Lending

cSigma Edge is revolutionizing private debt lending by eliminating gatekeeping, simplifying processes, and making it accessible to everyone. By empowering individuals to lend capital in a transparent and frictionless way, Edge is creating a community-driven platform that supports industries, maximizes yields, and enables lenders to make a meaningful impact.

Be sure to join the cSigma discord and follow us on X to stay up to date on product releases and be at the forefront of RWA private credit DeFi.

The information provided in this update is for informational purposes only and should not be construed as financial advice. cSigma does not endorse, guarantee, or take responsibility for any financial decisions made based on this information. Users should conduct their own research and consult with a qualified financial advisor before making any investment decisions. The use of cSigma’s platform and services is subject to the terms and conditions outlined on our website. All investments involve risk, and past performance is not indicative of future results.