csLYD

Yields from crypto funding cost, not direction

Capital actively rotates between strategies based on market conditions.

csLYD deploys across market-neutral strategies designed to generate returns regardless of direction.

Strategies are vetted and whitelisted by cSigma and may include:

Funding cost

Capture funding cost between spot and perpetual markets.

Capture yield from noncustodial and decentralized crypto backed lending.

Yield curve arbitrage

Capture duration-based inefficiencies in future yield curves.

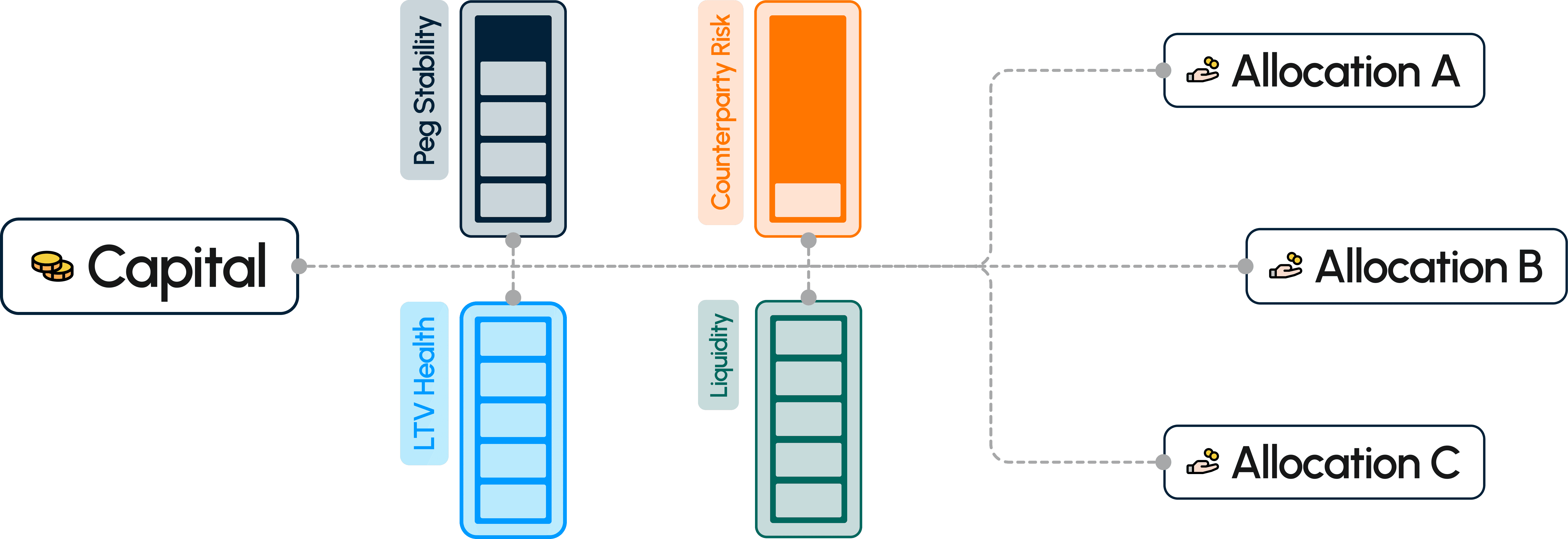

Similarly to csUSD, cSigma platform rotates csLYD funds across DeFi strategies based market conditions and other benchmarks, including:

LTV ratios based on collateral volatility

Daily monitoring of borrow rates, peg stability

Deep liquidity to unwind positions rapidly

None to extremely minimal counterparty risks

Trade yield for speed. Exit in hours instead of days.

csLYD keeps your capital liquid. All capital is deployed in yield positions that can be unwound in a few hours in most market conditions.