csUSD

Hands-free portfolio management

Blended yield that adapts to market conditions.

Deposit → USDC, USDT (or 8 other assets via in-app swapping)

Earn → Blended yield from RWA + DeFi

Redeem → Withdraw instantly or join queue

Capital flows between institutional credit and DeFi strategies, rotating to wherever yields are stronger.

DeFi yields compress? More flows to RWA. DeFi yields spike? More allocations shift to onchain.

Built to move with markets.

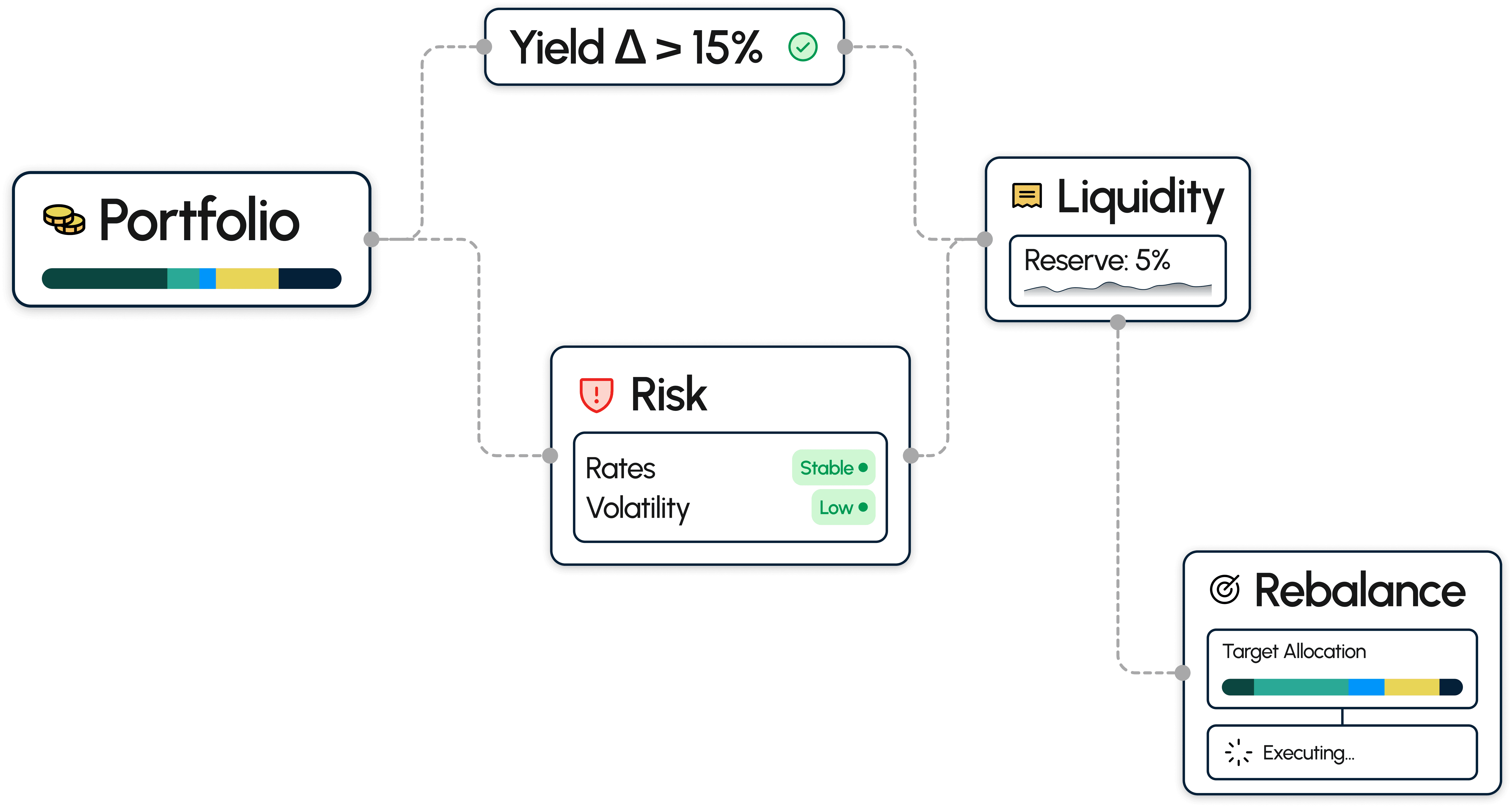

Traditional yield farming chases yield manually across multiple platforms. cSigma rotates capital based on real-time market analysis.

Yield differentials exceeding thresholds

Risk metrics breaching safety parameters

Liquidity requirements changing

Emergence of new strategies

The liquidity balance

Redemptions pull from vault reserves first. If depleted, requests join a First-In-First-Out queue.

DeFi positions unwind in hours, while RWA loans mature on 30-90 day schedules, creating steady repayment flows.