Edge Pools

What keeps sub-$25M loans mispriced?

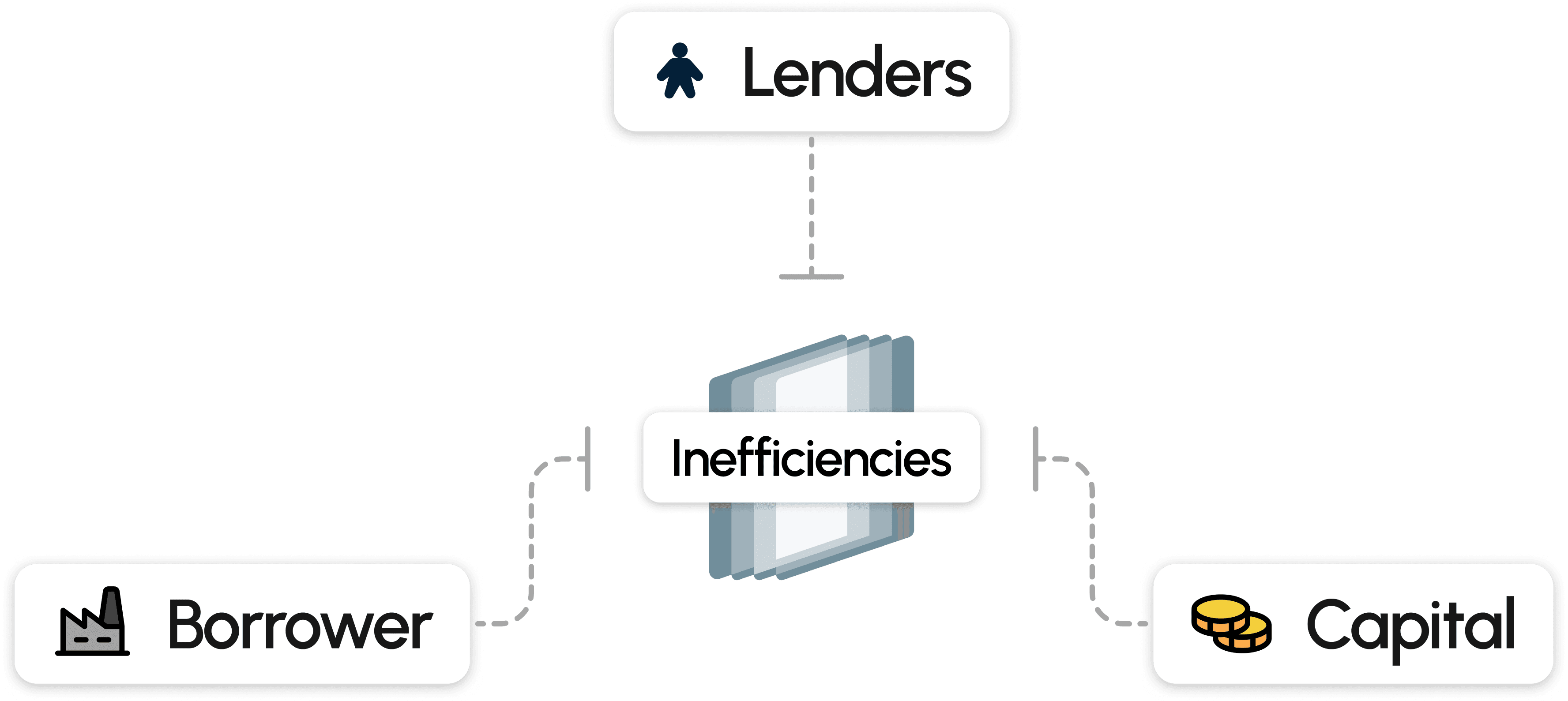

Inefficiencies in the current Financing system

Information asymmetry

Expensive manual processes

Lack of institutional interest

High-priced intermediaries

cSigma's infrastructure tackles this and connects onchain lenders directly to rigorously vetted, mid-market businesses that need working capital, inventory financing, or growth capital.

Institutional risk management across four dimensions.

All institutional borrowers must complete KYB and a credit assessment based on extensive benchmarks.

requirements

$20M+ raised in debt or equity

Asset coverage of at least 5x loan value

Strong creditor rights jurisdictions

All loan term agreements with cSigma's institutional borrowers include multiple layers of safeguards.

SAFEGUARDS

15-40% first-loss capital

Collateral: short-duration, self-liquidating assets

Additional security: credit insurance, equity stakes, and founder guarantees

cSigma's portfolio of borrowers implements a broad strategy to minimize overall credit portfolio risk.

DIVERSIFICATIONS

Geographic: US, EU, and Hong Kong

Industry: trade finance, revenue-based financing, AI software, and construction

Maturity: 1 to 6 months

cSigma's proprietary engine rates each borrower CCC to A based on a wide array of data points.

RATING FACTORS

Payment history

Financial performance

Loan book quality