$80M in tokenized loans

Standardized rails that connect real-world yield with onchain capital.

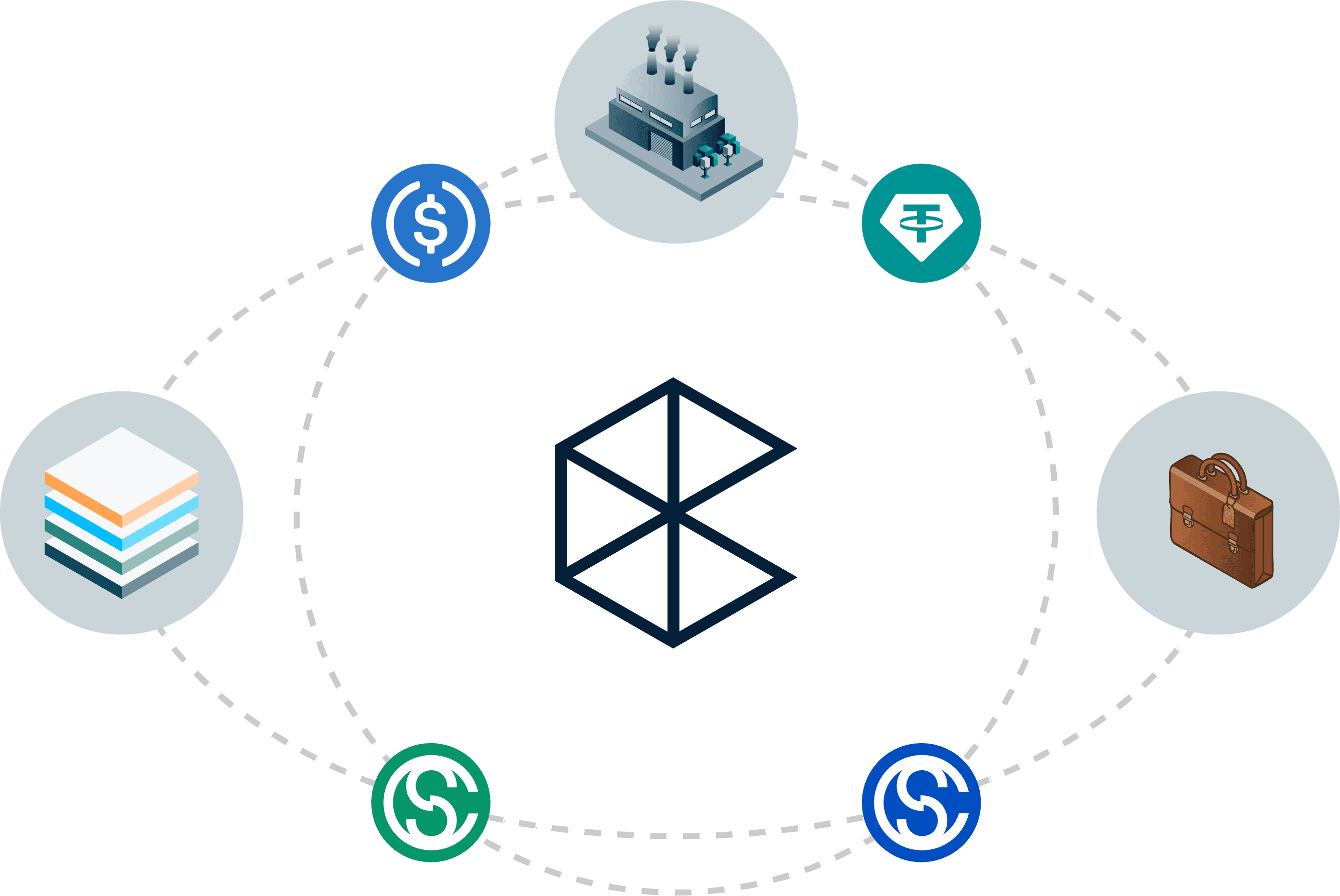

The stack powering financial asset tokenization

Tokenize loans and other assets using ERC-4626, ERC-7575, and other modern token standards.

Transparent ledger of assets and liabilities and real-time settlement of payments and obligations.

Seamless integration between AI risk engines and smart contracts with active monitoring.

Instant liquidity and a First-In-First out system for fair and transparent redemption.

Whether you're managing portfolios, seeking capital, or building financial products, cSigma's infrastructure extends you to Web3 and crypto.

Asset managers: Tokenize portfolios and tap into onchain liquidity.

Businesses: Borrow directly after KYB and credit assessment.

Protocols: Integrate composable, institutional yield into your capital vaults.

Institutional Lenders: One-stop interface for RWA and onchain yield

Permissioned and permissionless access

KYC'ed and vetted investors interacting in highly regulated jurisdictions.

AML-verified and accessible in permitted jurisdictions across the world.

Testimonials

Our payments solutions keep our 10K SMB merchant customers' lights on. We partnered with cSigma to offer flexible short-term capital for them to realize their full revenue potential.

– CFO (Revenue-Based Financing Borrower)

We're a boutique family office with little or no infrastructure to create and manage Private Credit exposure. cSigma helped us realize over 4% higher yield than publicly available credit opportunities.

– Managing Partner (Mid-Size Family Office)

We're excited to partner with cSigma to provide our 20,000 SMB customers access to capital from stablecoin investors. This partnership allows us to offer more flexible and affordable trade finance solutions.

– VP Finance (Trade Finance Borrower)