Dec 16, 2024

In the rapidly evolving world of decentralized finance (DeFi), stablecoins have emerged as a cornerstone, bridging the gap between traditional finance and the crypto ecosystem. With the total stablecoin market cap recently reaching $200 billion, their impact on the financial landscape is undeniable. They provide the stability necessary in a space often defined by volatility. Recognizing this potential, cSigma has pioneered attractive solutions for retail stablecoin lenders through its permissionless pools.

This post explores the crucial role of stablecoins in DeFi and delves into how cSigma connects crypto users to real-world yields, further increasing the yield of crypto holders.

The Role of Stablecoins in DeFi

What are stablecoins?

Stablecoins are digital currencies pegged to stable assets like the US dollar. By maintaining a stable value, they shield users from the extreme price fluctuations associated with cryptocurrencies like Bitcoin and Ethereum.

Why stablecoins are crucial in DeFi

In DeFi, stablecoins are instrumental for:

Lending and Borrowing: Offering a less volatile medium of exchange.

Yield Farming: Providing predictable returns.

Trading: Acting as a safe haven during market turbulence.

Their inherent stability makes them appealing to both institutional and retail investors looking to engage in DeFi without significant exposure to market volatility. However, many DeFi protocols remain reliant on crypto-based rewards, limiting their appeal to risk-averse investors.

cSigma: Bridging Real-World Yields and Blockchain

cSigma’s Unique Approach

cSigma distinguishes itself by connecting retail stablecoin lenders to high-quality institutional borrowing opportunities. Unlike traditional DeFi protocols, which often depend on volatile on-chain activities like token swaps or liquidity mining, cSigma generates yield from real-world financial activities.

Real-World Use Cases

By leveraging relationships with institutional borrowers in need of capital to grow their core business, cSigma created a permissionless platform where:

Retail lenders can earn stable and uncorrelated yields.

Institutional borrowers gain access to USD pegged capital on blockchain for operational and financial needs at a lower cost of capital. Borrowers can tap into Lenders around the world in a frictionless process.

This approach bridges the gap between traditional finance and DeFi, offering a more sustainable model for generating returns.

How cSigma Works

Here’s how cSigma connects retail stablecoin lenders to institutional borrowers:

Deposit stablecoins: Retail users deposit stablecoins into cSigma’s permissionless pools. These pools are accessible by anyone without the need for intermediaries.

Institutional Lending: cSigma approves carefully vetted institutional borrowers to receive capital from credit pools, ensuring safety and reliability.

Return Generation: Institutional borrowers pay interest on these loans every quarter and pay Principal at the end of the term of the loan.

On-Chain Transparency: All transactions, from deposits to interest payouts, are executed on-chain, ensuring transparency and security.

On-Chain Transparency and Security

Blockchain technology underpins cSigma’s operations, providing lenders with full visibility into how their funds are allocated and the returns generated.

Why Retail Lenders Choose cSigma

Stability and Predictability

By transferring yields from real-world businesses activities, cSigma minimizes the volatility associated with crypto-based rewards.

Accessibility Through Permissionless Pools

cSigma’s permissionless pools democratize access to institutional-grade lending opportunities. Retail users can participate without accreditation or complex onboarding processes, leveling the playing field.

Blockchain Transparency

The protocol’s on-chain transparency ensures trust and confidence, addressing common concerns about centralized platforms.

Diversified Yield Sources

Unlike traditional DeFi platforms, which depend on cyclical on-chain rewards, cSigma taps into off-chain real-world business needs. This diversification broadens income streams for stablecoin holders.

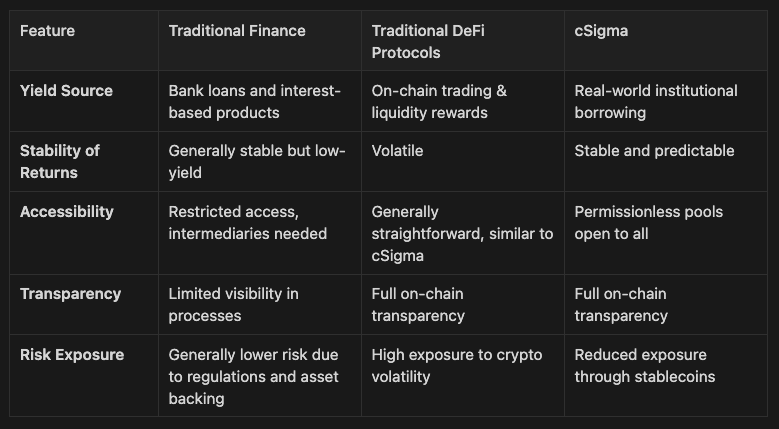

Comparing cSigma to Traditional Protocols

Press enter or click to view image in full size

cSigma combines real-world borrowing with on-chain accessibility.

Conclusion

Stablecoins have become indispensable in DeFi, providing stability and a gateway for broader participation. cSigma is reshaping the DeFi landscape by providing institutional grade yield that emphasizes sustainability, transparency, and accessibility. Through its permissionless pools, cSigma enables retail stablecoin lenders to earn predictable yields backed by real-world economic activity.

In a market increasingly seeking stable and sustainable financial solutions, cSigma’s approach sets a new benchmark. Explore cSigma’s pools today and be part of the future of decentralized finance — one that bridges the gap between traditional and digital economies.

Be sure to also join the cSigma community on Discord and Telegram, as well as following us on X to stay up to date on product releases and be at the forefront of RWA private credit DeFi.

The information provided in this update is for informational purposes only and should not be construed as financial advice. cSigma does not endorse, guarantee, or take responsibility for any financial decisions made based on this information. Users should conduct their own research and consult with a qualified financial advisor before making any investment decisions. The use of cSigma’s platform and services is subject to the terms and conditions outlined on our website. All investments involve risk, and past performance is not indicative of future results.